Please note that this is the Economic platform we took to the 2022 Election. Please refer to our current platform for our plans for the upcoming election.

The COVID-19 pandemic has shown that career politicians in the major parties have neither the will nor the capacity to serve the best interests of the nation.

Low and middle-income workers have been hardest hit, while corporations and wealthy shareholders have in many cases only increased their wealth. Governments have delivered primarily to vested interests – big business, union leaders, and the influential few – resulting in a weaker, less resilient economy.

What we aim for

Economic policy should guide our economy to be robust, efficient, and effective. It must maintain high standards of living, ensure a fair distribution of wealth, be a stable environment for business and manufacturing, foster worthwhile employment and excellent services, and do all this whilst conserving natural assets for future generations. Above all, economic levers must be transparently based on evidence.

We propose fundamental economic reforms, starting with an overhaul of the tax system. Our proposed tax reforms will more efficiently raise revenue that will be used to fund investments to transform Australia’s economy and pay down the debt that the government has taken on to manage the worst impacts of the pandemic.

Our plan will drive a fast transformation to very low greenhouse emissions by moving to an energy system characterised by renewable energy + storage and through the electrification of transportation, heating, and industrial processes. In doing this we must foster the scientists, innovators, and manufacturers who can build the business and employment opportunities that this transformation will offer.

Our economic reform package will deliver economic strength and stability in 3 key areas:

- A REFORMED TAX SYSTEM that is fairer and more effective;

- ECONOMIC STIMULUS that delivers strength by embracing the green transition and investing in the clean economy;

- SCIENCE AND INNOVATION investment that will deliver the knowledge and skills to create the jobs of the future

Summary elements of our economic reform package

| A MORE EFFECTIVE TAX SYSTEM |

| Make the first $37,000 of annual income tax-free – This will increase take-home pay for someone earning $37,000 a year by 11% |

| Stamp out profit-shifting by global firms by adding a global profit allocation test in calculating corporate tax |

| Levy moderate taxes on the wealthiest 1%. – Tax those with wealth of $100 million+ and inheritances of $10 million+ |

| Reduce the capital gains tax discount to 25% |

| Phase out stamp duties and replace them with land tax |

| RE-ORIENT TO A LOW CARBON ECONOMY |

| Implement a $30/tonne tax on carbon – To provide energy policy certainty which will drive private investment in the grid, create jobs, and lower energy prices – To be increased in line with Australia’s key trade partners |

| Invest in electricity transmission upgrades to ensure reliable energy (guided by the Australian Energy Market Operator’s Integrated System Plan) |

| Underwrite support for lithium-battery and hydrogen energy industries |

| Levy a super profit tax on non-renewable resource projects |

For details on the components of our economic reform package:

Re-evaluating our Economy for the 21st Century

Despite recording 28 years of uninterrupted growth, it was already clear prior to the pandemic that Australia’s economy was not working for everyone. In the last 20 years, manufacturing, as a percentage of GDP declined from 12% to 6%. Steel production has almost halved, and in the last five years, Holden, Ford and Toyota shut their Australian production.

These trends reflect the impact of globalisation and free trade, with industrial activity moving offshore and Australia’s economy becoming increasingly reliant on service industries like tourism, education, and finance & professional services. Australia is not alone in the changes we have observed over the past few decades. The share of GDP going to workers in the form of wages has declined in most of the developed world. Meanwhile, the portion of GDP going to corporate profits has rocketed.

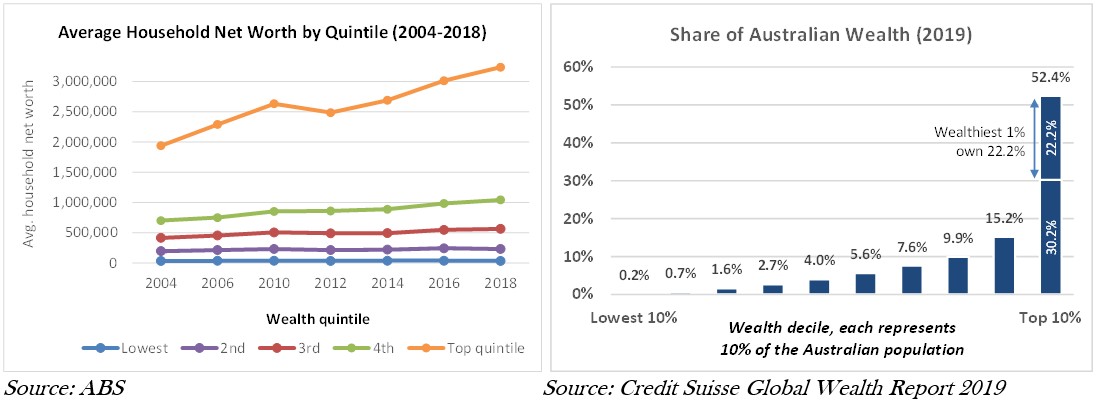

The economist Thomas Piketty (2013) argues that under neoliberal economic policies, those who make money from investment income have higher earnings capacity than workers who earn a salary. As a result, the rich get richer and the poor are locked out of participating in growth. We see this trend in Australia, with the evolution of wealth over the last 15 years resulting in severe wealth inequality (this is as far back as the ABS data goes). According to Credit Suisse, as of 2019, the bottom 10% of Australians owned 0.2% of all wealth, while the top 10% owned 52.4%.

It is one thing to have a high level of inequality, but it is another that it is getting worse. Now, the pandemic and associated lockdowns are disproportionately impacting young, low-income Australians. These are generally the same groups who were not able to participate in Australia’s economic growth ‘miracle’.

Adding to the failure of neoliberal economic policies, COVID is fast-forwarding the shift to automation, further reducing the bargaining power of workers. In economic terms, automation leads to a reduction in operating costs and an increase in fixed/capital costs. This new cost structure results in economies of scale which lead to the emergence of monopolies. The FAANG companies (Facebook, Amazon, Apple, Netflix and Google) are prime examples, but this phenomenon is not restricted to the tech sector. Mergers and acquisitions by global firms have resulted in a lessening of competition in the last 20 years. Simultaneously there has been a rise in corporate profit-shifting and tax evasion, as executives justify this as part of their ‘fiduciary duty’ to shareholders.

……. the system is producing self-reinforcing spirals up for the haves and down for the have-nots.

Ray Dalio, the founder of the world’s largest hedge fund, Bridgewater Associates describing the impact of these factors

In such a system, it is reasonable that a fair tax system would be progressive and would tax capital at a higher rate than wage income, because capital has higher earnings capacity.

Not only is this approach fair, it is also efficient. The evidence suggests that higher tax rates on the highest levels of income and wealth will not deter growth. The next generation of entrepreneurs like Atlassian co-founders Mike Cannon-Brookes and Scott Farquhar (whose self-confessed goals were “to make $35,000 a year and not have to wear a suit”) aren’t likely to be concerned with the tax rate they pay on each dollar they earn above the first 50 million. Depending on Atlassian’s share price on any given day, its co-founders each hold about US$12 billion in wealth.

This leads us to query the purpose of our economy, something that as far as we are aware hasn’t been addressed by the major parties. Without articulated purposes, the economy will only benefit those with vested interests, to the detriment of everyone else. While this is only a starting point, we propose the following basic purposes of the economy as a guide:

Our economy must be robust, efficient, and effective and must;

- maintain high standards of living

- ensure a fair distribution of wealth,

- be a stable environment for business and manufacturing

- foster worthwhile employment and excellent services,

- and do all this whilst conserving natural assets for future generations.

Above all, economic levers must be transparently based on evidence.

We must move away from focusing on aggregate GDP, which ignores how economic gains are distributed as well as impacts on the environment. RBA Governor Philip Lowe has noted we need policy that focuses on standards of living and not simply adding more people to make the economy look bigger.

Focusing on GDP leads to a short-term approach that is not desirable if we care about the quality of life of future generations, or for those of us who will live longer than a few more decades. It will lead to an increasingly scorched earth, with more intense bushfires, water scarcity, and coral bleaching. And ultimately, it will destroy our economy too.

We must re-evaluate both sides of the fiscal equation, taxation (how government raises revenue) and expenditure (what government spends on and how effectively this is spent). And we must ensure the appropriate policies are in place to regulate businesses.

To prompt this reassessment of the purpose of economic policy, we propose that the Government present an annual State of the Economy report providing an update on Australia’s performance on key economic indicators. The report should be no longer than 30 pages and accessible to all Australians, not just policy professionals.

The report should include indicators illustrating the state of Australia’s economy, such as:

| MEASURE |

PROPOSED METRIC |

| Economic well-being |

Personal income |

| Wealth inequality | Household net worth |

| Employment | Unemployment and under-utilisation rates |

| Quality of government | Breakdown of government taxation and expenditure |

| Financial system stability | Household debt-to-income |

1. Updating our Tax System for the 21st Century

Australia’s tax system was designed for an industrially-advanced economy, but not a technologically-advanced economy. The last time our tax system underwent structural reform was in the 1980s.

We need a tax system that is fit-for-purpose for the modern economy.

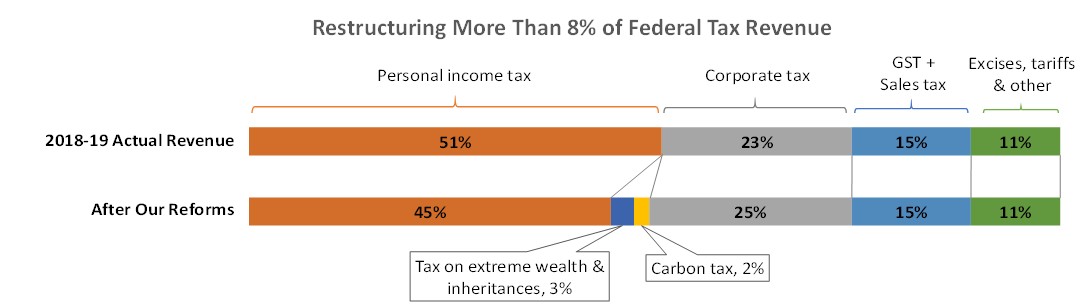

We are proposing 10 core tax reforms that will transform Australia’s tax system, restructuring more than 8% of total federal tax revenue.

Note: Based on total 2018-19 Commonwealth Government revenue of $456 billion. This illustration excludes revenue collected by state & local governments (such as payroll taxes, land taxes & stamp duties). State and local governments collected an additional $105 billion in revenues in 2018-19.

We propose the re-introduction of a carbon tax, which, in conjunction with our energy & infrastructure strategy, will create the incentive structures to drive the green transition. The revenue raised by the carbon tax will fund investment in the grid of the future and electrification across our economy.

Transformative tax cuts for low and middle income earners will mean a 11% increase in after-tax income for an individual earning $37,000 a year.

The data is very clear in showing that cutting tax for those with lower incomes will have the largest economic benefit, because this group spends the largest portion of every dollar they earn in income. National Accounts data from 2017-18 shows that the 20% of households with the lowest incomes spend $1.37 for every $1 they earn. The equivalent figure for the top 20% of households is just 70 cents for every $1 they earn. This means that our proposed tax cuts will flow back into the economy, creating a multiplier effect.

Our proposed income tax cuts will be funded by introducing moderate taxes on extreme wealth (above $100 million) and inheritances (above $10 million). Together our reforms will provide a net benefit to all but the wealthiest 2% of Australians.

We do not support the government’s stage 3 tax cuts which are a giveaway to higher income earners.

Recent empirical evidence shows that tax cuts for higher income earners do nothing to boost the economy. By the same token, levying higher taxes on the very wealth will do little to deter growth. The next generation of innovators and entrepreneurs like Atlassian founders Scott Farquhar and Mike Cannon-Brookes (whose self-confessed goals were “to make $35,000 a year and not have to wear a suit”) aren’t likely to be concerned by the tax rate they pay on every dollar they earn after the first hundred million.

In addition to our tax reforms for individuals, we will address corporate profit-shifting by multinational firms which has become rife in the last 20 years. It is simple; business that is undertaken in Australia should be taxed in Australia. It is a lie that Australia has a globally uncompetitive corporate tax rate. Analysis by Kevin Davis and Miranda Stewart from the University of Melbourne shows that when our imputation system is taken into account, the real corporate tax rate in Australia is between 15% and 20%, low relative to other developed nations.

Our reform plan will release the purchasing power in the economy, by shifting the tax burden away from lower and middle income earners and it will drive the green transition, by investing in clean energy and putting a price on carbon.

A summary of our 10 proposed reforms is below. More detailed information and analysis can be provided on request.

We should be properly enforcing corporate taxation and not be cutting it.

We are proposing 10 core tax reforms:

| Simplify the tax system |

The 2009 Henry Review found that Australia had 125 different taxes and suggested rationalising taxes that contribute minor amounts of revenue. |

| Phase out stamp duties |

Transaction stamp duties to be phased out and replaced with broad-based land taxes over a transitionary period. – This reform will be revenue-neutral and will allow people to move more freely as they won’t face large transaction costs on buying and selling properties. – To avoid taxing agricultural land, land below a certain value per square metre should be exempt, as should the principal place of residence. |

Carbon tax | Implement a carbon tax of $30/tonne with the intention of increasing the price in line with Australia’s key trade partners A price on carbon forms a key part of our plan to drive the clean energy transition |

| Abolish the lowest personal income tax bracket | Increase the tax-free threshold for personal income tax to $37,000 (from the current $18,200) by abolishing the lowest tax bracket. – This will increase take-home pay by 11% for someone earning $37,000 |

End corporate tax avoidance | As a principle, design policy so that economic activity that takes place in Australia is taxed in Australia and not shifted to tax havens Specifically: – For multinational corporations, tax liability is to be assessed against the portion of global profits that come from Australian sales (identical to the system used by individual US states to allocate state-level corporate tax.) – Increase funding to the ATO to properly enforce corporate taxation and combat profit shifting by multinational corporations |

Tax on extreme wealth | Introduce a tax on the hyper-wealthy, calculated as the greater of a and b below, based on the following tiers: a. A tax on extreme wealth, based on the following tiers: – 1% p.a. tax on wealth between $100 million and $500 million – 2% p.a. tax on wealth between $500 million and $1 billion – 4% p.a. tax on wealth over $1 billion b. 10% tax on annual earnings greater than $3 million |

| Inheritance tax on amounts over $10m | Introduce an Inheritance Tax of 15% on all endowed amounts above $10 million. Applied to all assets irrespective (no discounting or concessions). |

| Capital gains discount | Reduce from 50% to 25% |

| Negative Gearing | Change negative gearing rules to only apply to investment in new housing |

| Tax super profits on non-renewable resource extraction | As recommended by the 2009 Henry Review of Taxation |

We needn’t pick a side between labour and capital, but instead observe the secular changes at play in the economy and structure our tax system in a way that maximises well-being for Australians.

There is a middle way, that harnesses the efficiencies of capitalism while providing equal access to quality healthcare and education, a social welfare net, and that incorporates concern for the impacts of economic activities on the natural environment.

2. Economic Stimulus, Energy and Infrastructure

The impacts of the pandemic have been severe, and it is reasonable that Australians look to government for support in the form of unemployment assistance (Newstart/JobSeeker), wage support (JobKeeper), or the range of other measures the government has put in place.

A key challenge is how to transition out such measures once the worst economic impacts of the pandemic (and lockdowns) have passed. This is made particularly difficult given the uneven spread of the pandemic in each state not to mention the disproportionate impact upon already vulnerable groups in society.

We agree with the Reserve Bank Governor’s statements to the Parliament’s Standing Committee on economics on 14 August, that ultimately, stimulus should focus on job-creating investment rather than income support and other cash handouts. Fortunately, there are compelling investments in electricity, transport and other infrastructure that can be made now to stimulate and drive the transformation.

Energy and infrastructure

The main barrier to driving investment in the right types of infrastructure is political. Governments on both sides have prioritised projects with short-term development timelines because this provides quick political wins.

The key to successful infrastructure planning is long-term thinking and consistency of policy.

For instance, there would be no energy crisis if the government had simply committed to a stable energy policy (almost regardless of what that policy was)!

The energy sector is vital in driving the economy post-COVID-19. Energy costs are critical to any business. We will commit to transitioning to a clean energy system domestically and then developing the capacity to export surplus energy to our Asian neighbours. Technological advancements have led to dramatic reductions in the cost of renewable energy resources, so that they are now cost-competitive with fossil fuels. The market will invest in renewables without government subsidies provided the appropriate grid backbone is in place and investors have confidence that the government will be consistent in its energy policy.

We’ve now shifted from wondering whether wind and solar are our cheapest resource to a new set of problems which is: how do we efficiently integrate these resources into the system so that we can take full advantage of the fact that for the first time in this industry we can use free fuel?

Audrey Zibelman, CEO Australian Energy Market Operator

The challenge to scaling-up renewable energy is not cost, but addressing the issues related to the intermittency of solar and wind power. This is caused by the fact that the sun is not always shining and the wind is not always blowing. In order to integrate renewable energy into the grid without reliability issues arising (such as those observed recently in South Australia and Victoria), there must be ample energy storage to allow renewable energy to be stored for use at a later time. The capacity of the transmission grid must also be bolstered to manage the reconfigured flows of electricity through the network and allow for more widespread sharing of energy resources..

To store energy for use at times when renewables are not producing, investment in grid-scale storage will be critical.

This can be achieved through investments in pumped hydro storage projects such as Snowy Hydro 2.0 and battery storage.

To incentivise private investment, an overhaul of the electricity design market rules is required to properly compensate energy storage. The ‘energy only’ design of the National Energy Market is an outlier globally. Almost all other deregulated electricity grids around the world have both energy and capacity markets. Under Australia’s energy only market, critical services such as load balancing (the key service that storage provides) and inertia are not compensated in the market.

The government is dragging its feet on energy market reform because it is fearful of upsetting utility owners whose asset values will be affected by regulatory change. While the impact that change will have on investors is important, it is not a reason to maintain the status quo, with “1 in 100 years” bushfires occurring every few years.

As Australia reforms its energy market, we can take lessons from markets such as Denmark and California, who have adapted market design rules to accommodate the scale-up of renewable energy. Once the appropriate market design is in place, the private sector driven by super funds looking for long term reliable returns will provide the funds required to develop green infrastructure. Where enabling investment is required in transmission or generation (including energy storage), financing can be provided through the Clean Energy Finance Corporation. The Australian Energy Market Operator’s (AEMO’s) Integrated System Plan provides a clear blueprint for the transmission grid of the future.

While grid-scale energy storage will help commercial and industrial energy users to meet their requirements using renewable energy, investment in distributed storage (e.g., batteries) will allow residential and small business customers to use renewable energy at times when the sun isn’t shining and wind isn’t blowing.

n short, our energy & infrastructure platform includes:

| 1 | Implementing a $30/tonne emitter-pays price on carbon |

This will provide energy policy certainty, prompting private investment in the electricity grid, creating jobs, and lowering energy prices. |

| 2 | Overhauling Australia’s electricity market design | This will align with international best practice, incorporating a flexible capacity market to underwrite load-balancing electricity generation and introduce more granular price signals to enable real-time demand side management |

| 3 | Invest in transmission line upgrades | Ensuring energy reliability by further integrating and reinforcing the historically disparate state electricity grids that make up the National Electricity Market (guided by the Australian Energy Market Operator’s Integrated System Plan). Focus should be given to projects designated by AEMO as ‘Actionable’, including Project EnergyConnect (connecting the NSW and SA grids), HumeLink (reinforcing the grid in southern NSW) and Marinus Link (connecting Tasmania and Victoria). |

| 4 | Underwriting support for our lithium-battery and hydrogen energy industries | To support Australia’s emergence as a renewable energy superpower. – Lithium-ion batteries will play a role in providing short-duration storage for stationary energy and electric vehicles – Hydrogen is expected to provide longer-duration utility-scale storage and be favoured for heavy vehicle applications. |

| 5 | Levying a super profit tax on non-renewable resource projects | Ensure public participation in profits on the sale of scarce national resources |

| 6 | Developing a national strategy to address coastal inundation |

Because burying our heads in the sand is not a strategy |

3. Energy Innovation

Governments cannot simply buy innovation. Innovation occurs when the right conditions exist; groups of educated and entrepreneurial individuals working in an environment conducive to new ideas are incentivised to bring these ideas into new ways of doing things.

Historical precedents show that government can successfully foster innovation by defining the right policy settings and carefully selecting targeted enabling investments. These enabling investments can have massive economic multiplier effects when they stimulate private investment.

This is especially true for new technologies such as electric vehicles and hydrogen fuel applications, where there is a chicken and egg problem: people won’t buy the products until the enabling infrastructure exists, and private investors are unwilling to risk financing and building the required infrastructure without knowing there will be customers. This is where the support of government can be crucial.

By providing incentives, government can achieve a high return on investment and stimulate the growth of new industries.

To do this, we propose the following enabling investments and supporting measures:

| Target 100% decarbonisation of transportation by 2050 An immediate $240m investment to electrify 500 metropolitan commuter buses (as recommended in the WWF’s renewable stimulus plan). This will stimulate demand for the local lithium industry, driving private investment in our nascent lithium industry and position Australia to provide electric buses to Indonesia and other markets |

| Re-design urban transport corridors to encourage e-bikes and other small EVs |

| Provide grants to reduce energy costs for critical manufacturing $220m in investment grants to support energy system modernisation for up to 1,000 Australian manufacturers, substantially lowering their energy costs |

| Switch all residential gas heating and cooking to electric systems by 2030 |

| Expand Australia’s support for green hydrogen under the existing $300m Advancing Hydrogen Fund, including participation in hydrogen electrolysis and storage pilot projects |

| Establish a Just Transition Authority charged with planning the transition from fossil fuels, fostering job creation where it is needed and managing the economic impacts as opportunities evolve |

The Government’s Australia 2030: Prosperity Through Innovation Plan identifies 5 strategic policy imperatives in its innovation strategy; education, industry, government, R&D and culture & ambition. These may be relevant areas, however commitment to this plan has been patchy, largely lip service. With the Government now promoting a gas-led recovery, it is clear they are looking to the dirty industrial economy of the past, not an innovative clean economy of the future.

The COVID-recovery is an opportunity to stimulate the transformation of the economy from the bottom-up, channeling the national mobilisation that took place during the world wars. The Australian Chair of Tesla, Robyn Denholm, has noted that the annual market opportunity just for lithium-ion battery products is 8 times what Australia’s coal revenues were in 2020. The opportunity is massive and the world is already moving.

We need a Transformational New Deal which drives the transformation from fossil fuels to renewable energy + storage, with the electrification of transportation, heating, and industrial processes.

Photo: Hush Naidoo Jade Photography on Unsplash